Preparing Your Home for Sale

11 Tips for Selling Your Out of State House – When selling your out-of-state house, first impressions are everything. Preparing your home not only involves a few repairs and upgrades but also staging to showcase its true potential. A well-prepared home can attract more buyers and potentially lead to a quicker sale at a better price.To enhance your home’s appeal, focus on necessary repairs such as fixing leaky faucets, painting scuffed walls, and ensuring that all appliances are in working order.

Upgrades like modern lighting fixtures or energy-efficient windows might also create a significant impact. Staging your home effectively means arranging furniture to create inviting spaces and decluttering to make rooms appear larger. Don’t forget about curb appeal—keeping your lawn well-manicured, adding colorful flowers, and ensuring the front door is fresh and welcoming can make a substantial difference.

Detailing Repairs and Upgrades

The first step in preparing your home is identifying repairs that need to be addressed. Here are some key areas to focus on:

- Fix any leaks or plumbing issues to avoid future problems.

- Paint walls in neutral colors to appeal to a wider audience.

- Replace outdated fixtures or hardware to modernize your space.

- Consider upgrading appliances to energy-efficient models.

- Ensure that your HVAC system is serviced and functioning properly.

Importance of Staging

Staging is crucial in making your home feel inviting and spacious. It’s about highlighting the best features of the house while making it easy for potential buyers to envision themselves living there. Here are some staging tips:

- Remove personal items and excessive decor to allow buyers to imagine their own belongings in the space.

- Use neutral furniture and accessories to create a cohesive look.

- Arrange furniture to promote flow and functionality in each room.

- Ensure that each room has a clear purpose, demonstrating how the space can be used effectively.

Improving Curb Appeal

Curb appeal is the first visual representation of your home that potential buyers will see. Here are some strategies to enhance this aspect:

- Mow the lawn regularly and trim any overgrown bushes.

- Add potted plants or flowers by the entrance for a welcoming touch.

- Power wash the exterior and walkways to remove dirt and grime.

- Make sure the mailbox and house numbers are clean and visible.

- Paint or replace the front door to give it a fresh look.

Pricing Strategies for Out of State Homes

Setting the right price for your home is critical in ensuring a successful sale. The pricing strategy should reflect market trends and the unique attributes of your home while considering regional variances. Conducting a comparative market analysis (CMA) is essential in determining a fair price. This involves looking at recent sales of similar homes in your area, factoring in their size, condition, and location.

Additionally, understanding regional factors, such as local demand, economic conditions, and the time of year, can influence your pricing strategy.

Conducting a Comparative Market Analysis

A thorough CMA can help you price your home competitively. Consider these steps:

- Research recent sales of comparable properties in your neighborhood.

- Evaluate the current market trends—are homes selling quickly or lingering on the market?

- Adjust your price based on any unique features your home has compared to others.

- Consult with your real estate agent for professional insights and adjustments.

Factors Influencing Pricing

Different regions may have varying factors that influence home pricing. Key considerations include:

- Local job market and economic conditions that could impact demand.

- Seasonal trends that could affect buyer interest.

- Proximity to schools, parks, and commercial areas that add value.

- Historical data on property values in your specific neighborhood.

Examples of Pricing Strategies for Remote Sales

When selling a home from a distance, you might want to adopt specific pricing strategies, such as:

- Start slightly below market value to attract attention and create urgency.

- Offer incentives, such as covering closing costs, to entice buyers.

- Regularly reassess your pricing based on feedback from showings and market changes.

Selecting the Right Real Estate Agent

Choosing the right real estate agent is essential when selling your out-of-state home. An experienced agent will help navigate the complexities of remote sales while ensuring your interests are represented.When selecting an agent, prioritize those who have a proven track record in out-of-state transactions and excellent communication skills. Availability for updates and inquiries is crucial, as you’ll want to stay informed throughout the selling process.

Evaluating the agent’s marketing plan will also give insights into how they plan to attract potential buyers.

Criteria for Choosing an Agent

Look for specific traits in an agent that align with your needs:

- Experience in out-of-state home sales.

- A strong understanding of the local market dynamics.

- Positive reviews or testimonials from past clients.

- Ability to explain the selling process clearly and answer all your questions.

Communication and Availability

Effective communication is essential, especially when you’re not physically present. Ensure your agent:

- Provides regular updates on showings and feedback from potential buyers.

- Is reachable via multiple channels (phone, email, text).

- Can provide timely responses to inquiries or concerns.

Evaluating an Agent’s Marketing Plan

A robust marketing plan is vital for reaching potential buyers beyond your local area. Consider:

- How the agent plans to list your property on various platforms.

- The use of social media to create buzz and visibility.

- Inclusion of professional photography and virtual tours in their strategy.

Marketing Your Out of State Property

An effective marketing strategy can significantly increase your chances of selling your out-of-state home quickly. Utilizing the right platforms and tools can broaden your reach to prospective buyers.Several online platforms allow you to list your home, while social media can amplify your marketing efforts. Professional photography and virtual tours can make your property stand out from the competition.

Effective Online Platforms for Listing Homes

To maximize your home’s exposure, consider these platforms:

- Real estate websites like Zillow, Realtor.com, and Trulia.

- Local Multiple Listing Service (MLS) websites for targeted exposure.

- Social media platforms, including Facebook and Instagram.

- Real estate app platforms that cater to mobile users.

Leveraging Social Media

Social media is a powerful tool for reaching a wider audience. Here’s how to use it effectively:

- Post engaging content, including high-quality images and videos of your home.

- Utilize targeted ads to reach specific demographics interested in your location.

- Encourage sharing by creating posts that highlight unique features of your property.

Role of Professional Photography and Virtual Tours

High-quality visuals can significantly impact buyer interest. Consider the following:

- Invest in professional photography to capture your home in the best light.

- Create virtual tours to allow potential buyers to walk through your home online.

- Utilize drone footage to showcase the property and surrounding area.

Understanding Legal Considerations

Navigating the legal aspects of selling a home from a distance can be complex. Each state has its own regulations, and understanding these is crucial for a smooth transaction.Ensure you’re familiar with the paperwork required for out-of-state sales, including disclosures and contracts. Additionally, be aware of any tax implications that might arise during the process.

State-Specific Regulations for Selling Property

Different states have unique laws regarding real estate transactions. Here are some aspects to consider:

- Disclosure requirements about the property’s condition.

- Specific forms needed for out-of-state sales.

- Local zoning laws that could affect your property sale.

Paperwork Required for Out-of-State Transactions

The paperwork can be extensive. Here’s what you typically need:

- Sales contract detailing the terms of the sale.

- Property disclosures as mandated by state law.

- Tax documents related to the sale.

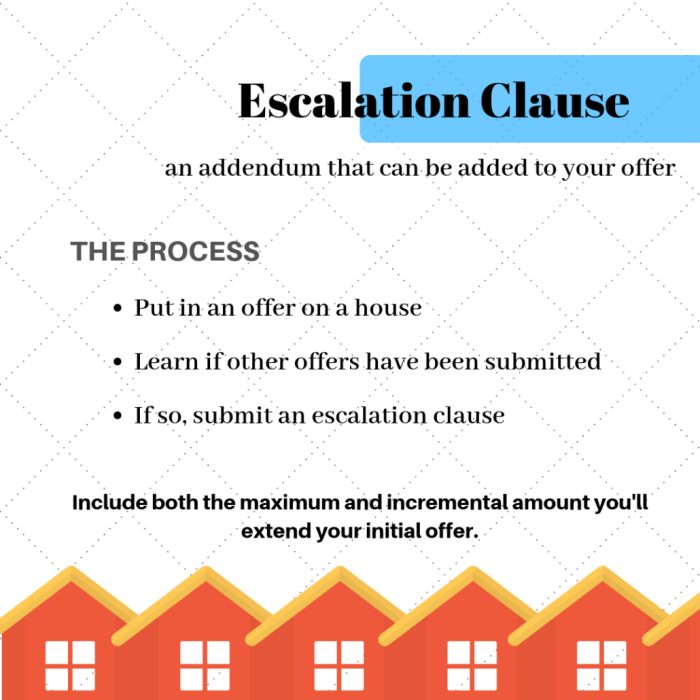

- Any relevant addendums for contingencies or special requests.

Navigating Tax Implications

Selling a home can carry tax consequences. To navigate this:

- Consult with a tax professional to understand potential capital gains taxes.

- Keep thorough records of expenses related to the sale that might be deductible.

- Consider state taxes that may apply when the sale is concluded.

Managing Showings and Open Houses

Coordinating showings from a distance requires planning and the right tools. While you may not be able to attend in person, you can still create opportunities for potential buyers to view your home.Utilizing technology for virtual tours can enhance your reach, and gathering feedback from showings can help you refine your approach to selling.

Coordinating Showings from a Distance

To manage showings effectively:

- Ask your agent to schedule showings at convenient times for potential buyers.

- Consider hiring someone locally to assist with in-person showings if needed.

- Use a digital calendar to keep track of scheduled showings and feedback.

Using Technology for Virtual Tours

Technology can facilitate remote viewing experiences:

- Provide 360-degree virtual tours that allow buyers to explore your home online.

- Utilize video calls for live walkthroughs with interested buyers.

- Incorporate video content highlighting the home’s features and neighborhood.

Gathering Feedback from Showings

Feedback is essential for understanding buyer perceptions. Implement these strategies:

- Request feedback from your agent after each showing to identify any common concerns.

- Adjust your marketing strategy based on the feedback provided.

- Be open to making minor changes to the home if consistent issues arise.

Negotiating Offers Effectively

Negotiating offers remotely can be challenging but is a critical component of the home-selling process. Understanding how to evaluate offers and respond appropriately can lead to a successful sale.When assessing offers, consider not just the price but also the terms and contingencies that may come with them. Crafting counteroffers strategically can ensure you get the best possible deal.

Assessing Offers Remotely

When you receive an offer, it’s essential to:

- Review the entire offer, including price and contingencies.

- Evaluate the buyer’s financial qualifications to ensure they can follow through.

- Consult with your agent to understand market conditions that may affect your decision.

Strategies for Counteroffers and Closing Negotiations

To navigate counteroffers effectively:

- Determine your bottom line before entering negotiations.

- Be willing to compromise on certain terms while holding firm on others.

- Communicate clearly through your agent to avoid misunderstandings.

Common Terms and Contingencies to Consider

Know the key terms that often arise in offers:

- Inspection contingencies that allow buyers to evaluate the home.

- Financing contingencies based on the buyer securing a mortgage.

- Closing date flexibility that may impact your plans.

Handling Inspections and Repairs

Home inspections are a standard part of the selling process, and knowing how to handle them can save you headaches later. Understanding what to expect during inspections and managing any resulting repair requests is crucial.Pre-inspection before listing your home can help identify issues and streamline the process. If repair requests arise, having a strategy in place can make negotiations smoother.

The Importance of Pre-Inspection

Conducting a pre-inspection can provide insights into potential problems before buyers see the home. This approach allows you to:

- Address issues proactively, enhancing buyer confidence.

- Set realistic pricing based on the condition of the home.

- Reduce surprises during the buyer’s inspection, leading to smoother negotiations.

Managing Repair Requests from Buyers

When buyers request repairs, it’s essential to:

- Evaluate requests carefully, prioritizing significant issues that could affect the sale.

- Consider negotiating repairs instead of completing them, if feasible.

- Keep a clear line of communication with buyers about repair expectations.

Handling Disputes Over Repair Negotiations

If disputes arise regarding repairs:

- Document all communications and agreements related to repairs.

- Be flexible and open to negotiations but know your limits.

- Involve your agent in discussions to mediate effectively.

Closing the Sale from Afar: 11 Tips For Selling Your Out Of State House

The closing process can feel overwhelming, especially when you’re not physically present. Understanding the steps involved and working with reliable professionals can ease the process.Ensure you stay informed about the closing schedule and requirements. Having trustworthy title companies and escrow services is critical to facilitate a smooth transaction.

Steps Involved in the Closing Process, 11 Tips for Selling Your Out of State House

Know the steps to expect during closing:

- Review and sign closing documents, often done remotely.

- Confirm the final sale price and terms with all parties involved.

- Coordinate with your agent to ensure all paperwork is complete.

Importance of Reliable Title Companies and Escrow Services

Working with reputable professionals is key:

- Choose a title company with a strong track record in out-of-state transactions.

- Ensure the escrow service has reliable communication and prompt processing.

- Stay informed about fees and specific state requirements for closing.

Timeline for Closing Phase

Understanding the timeline can help you prepare:

- Expect the closing process to take anywhere from 30 to 60 days after accepting an offer.

- Be prepared for potential delays if issues arise during inspections or appraisals.

- Set reminders for important deadlines related to closing to stay on track.

Maintaining Communication Throughout the Process

Open communication is essential throughout the selling process. A communication plan can help ensure you remain informed and connected to your real estate agent and potential buyers.Using technology to monitor progress can keep you updated and allow you to address any challenges as they arise.

Creating a Communication Plan

To stay in touch effectively:

- Establish regular check-in times with your agent for updates.

- Utilize email and messaging apps for quick communication.

- Artikel your preferred methods of contact and response times.

Using Technology to Monitor Progress

Leverage technology to stay informed:

- Use online tools that provide updates on showings and feedback.

- Set up a shared document for tracking important dates and tasks.

- Participate in video calls for face-to-face updates with your agent.

Addressing Concerns or Challenges Clearly

When issues arise:

- Be proactive in raising concerns with your agent for timely solutions.

- Document any issues and resolutions discussed to avoid confusion later.

- Encourage an open dialogue to foster a collaborative relationship.

Post-Sale Considerations

After selling your property, managing the transition can be crucial for a smooth experience. Addressing unresolved issues and considering future investment opportunities in real estate can help you plan your next steps.Understanding what to do after the sale is just as important as the selling process itself. This includes handling any loose ends and exploring new avenues for investment.

Managing the Transition After Selling Your Property

Post-sale, stay organized with these steps:

- Confirm that all financial transactions related to the sale are completed.

- Notify relevant parties of the sale, including utilities and services.

- Keep detailed records of the sale for future reference.

Handling Unresolved Issues Following the Sale

If issues arise post-sale:

- Communicate with your agent or attorney regarding any disputes.

- Document all correspondence relating to unresolved matters.

- Be prepared to negotiate solutions with the new owners if necessary.

Strategies for Future Investment Opportunities

Consider future ventures in real estate by:

- Researching emerging markets that offer growth potential.

- Understanding investment strategies, such as rental properties or flipping houses.

- Networking with real estate professionals to discover new opportunities.